CBJ Tax Abatement Programs

The CBJ Housing Action Plan recommended the creation and use of tax abatement programs to encourage the development of workforce, senior, high-density, and downtown housing. There are four tax abatement programs currently in place.

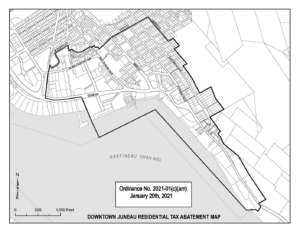

Downtown Tax Abatement: CBJ code 69.10.023 provides 12-year tax abatement for projects that develop at least four new residential units in the area of the Downtown Juneau Residential Tax Abatement Map, dated January 20, 2021. Such units must not be used as short-term rentals during the property tax abatement period.

Senior Assisted Living Tax Abatement: CBJ code 69.10.023 provides 12-year tax abatement for projects that provide at least 15 new residential units of assisted living for senior citizens in the urban service area.

Subdivision Property Tax Abatement: Property taxes derived from the increase in assessed value and directly attributable to the subdivision of a single parcel of property into three (3) or more parcels and any improvements made to the property necessitated by its subdivision may be exempted for a maximum of five (5) years

High Density Housing Tax Abatement Application: CBJ code 69.10.023(a)(3) provides 12-year tax abatement for projects that develop at least four new residential units within the Urban Service Area.