Payroll A to Z

-

Address Changes:

If you know you are moving, it is important to update your address information with Payroll. This helps ensure you receive all your paychecks and tax documentation on time and at the proper address.

Current employees may update their mailing address on their own in ESS: http://ess.juneau.org

-

- Personal Information>Move

- Home = Mailing Address

- Supplemental = Physical Address

NOTE: Be sure to send the auto generated email to Payroll so PERS (SOA Retirement & Benefits) can be manually updated.

For MissionSquare Retirement:

Log into your account and update. Website: www.msqplanservices.org/myplan/301285

Past employees must update their address directly through Payroll.

-

Beneficiary Designation Changes:

PERS:

Tiers I-III can complete a paper form: PERS Tiers I-III Beneficiary Designation Form

Tier IV can update online via their Empower Life & Annuity account: Welcome to the Alaska DCP Site! (empower-retirement.com)

MissionSquare Retirement: Update online here: www.msqplanservices.org/myplan/301285

-

Benefits:

CBJ provides comprehensive services for employees. Benefits include health, dental, life, accidental death & dismemberment, Group Voluntary Benefits, health & dependent care spending (flex) accounts, retirement plans, workers’ compensation & paid time off.

Details can be found here:

-

Cell Phone Stipend Agreement:

-

- Read Information & Communications Policy and Cellular Devises Policy located here:

https://juneau.org/manager/administration-policies-and-procedures

-

- Fill out Cellphone Stipend Agreement on the internal intranet page (Finance>Payroll>Lists)

-

Clocking issue (UKG, formerly KRONOS)

If you are unable to login or punch using UKG, notify your Department Admin (or Payroll if Admin is unavailable).

-

Comp Time Cashout:

On your UKG timesheet:

-

- Select CT CashOut from the Pay Code Column drop down menu

- In the corresponding Amount column cell, enter the amount of Comp Time you wish to cash out.

TIP! To view your current leave balances, expand the bottom of your timecard by clicking the totalizer (two grey lines with a triangle). Your balances will display in the Accruals tab. If you notice your totals do not match your ESS (Lawson) balance, please contact your Dept. Admin or Payroll.

-

Deferred Comp:

- CBJ Employees can set up additional funds to be sent to a deferred compensation account through MissionSquare Retirement . Employees can sign up and login via their website:www.msqplanservices.org/myplan/301285

- MissionSquare does not use paper for enrollments & changes, so employees should go online or call 1-800-669-7400.

- Important to note: Changes can now be made biweekly. Cutoff is Sunday prior to payday.

- New July 2023 – You’ve always been able to invest money for your retirement through the deferred compensation program. But now when you contribute to your deferred compensation account, CBJ will match that contribution by up to 50%. Depending on your years of service, CBJ will match up to 4% of your annual income. Refer to the Frequently Asked Questions (FAQ) sheet for details. MissionSquare CBJ Match FAQ

-

Direct Deposit:

- Direct Deposit eliminates the need for paper paychecks & the hassle of receiving paychecks via the Postal Service.

- Funds are automatically received on payday into your bank account, perfect for those traveling with no access to their mailbox.

- *NEW OPTION SEPTEMBER 2021*: Payroll can now deposit to a Money Network bank card where funds can be accessed at banks, stores & ATM’s nationwide. Contact Payroll if you would like to sign up or learn more!

HOW TO ENROLL: Enrolling is easy and secure. Payroll currently does not offer an online method of direct deposit enrollment. In an effort to increase the security of the enrollment process, verification of identity is required when signing up for, or making changes to, direct deposit.

Step 1) Complete the FORM found here: Finance – All Forms – City and Borough of Juneau

Step 2) Attach supporting documentation

Step 3) Submit your information and verify your identity.

HOW TO CHANGE OR STOP YOUR DIRECT DEPOSIT:

Employees wishing to change their direct deposit must complete a new form providing the new account information. All requests will be verified prior to taking effect.

Employees wishing to stop direct deposit must complete a new form noting the request. All requests will be verified prior to taking effect.

All changes to direct deposit information, including stopping direct deposit must be received ten (10) business days prior to the payday for which they will be effective.

Payroll can’t stop direct deposit payments after payroll has been processed (generally four business days prior to payday).

-

Donated Leave:

- Qualified employees can apply to receive leave donations from other employees:

Step 1: Employee needing leave requests to receive donations using the Leave Donation Qualification Form found here: Finance – All Forms – City and Borough of Juneau . This is sent to Payroll.

Step 2: Need for leave is advertised by the Department Admin per instructions on form.

Step 3: Employees wishing to donate leave, complete the Leave Donation Form found here: Finance – All Forms – City and Borough of Juneau

Step 4: Leave is processed by Payroll

Step 5: When need for leave has ended, Payroll returns the leave to donors in reverse order received.

-

Employee Self-Service:

Access to your pay stubs, leave balances, benefits information, and more here: http://ess.juneau.org

-

Employment Verification’s:

For employment verifications including dates of hire/termination, position/title, and salary information, please email us.

-

FMLA:

https://juneau.org/human-resources/employee-forms-info

-

Fobs:

Most full time employees must use a fob to clock in/out of the timekeeping system (UKG).

Parks & Rec – Building Maintenance activates and maintains fobs.

Lost, Damaged, or Not Working? Contact them at 586-5308!

-

Garnishments:

CBJ adheres to all legal regulations regarding all types of garnishments. For information on garnishments, contact Payroll, (907) 586-5215, opt. 5.

-

Holiday Schedule:

CBJ offers up to 12 paid holidays throughout the year. The holiday schedule can be found on HR’s webpage here: https://juneau.org/human-resources/employee-forms-info

-

Jury Duty:

For scheduled day(s) of work, employee submits a time off request as Jury-Court Leave in UKG.

When an employee receives compensation from the clerk of court for jury duty service, they must reimburse the CBJ if they were paid for their time away from work. If the jury service occurred on a day off, or during pre-determined personal leave, no reimbursement to the CBJ is required.

Jurors are paid a daily rate. The daily rate amount should be turned over to the CBJ. The employee should restrictively endorse the check from the court by writing “Pay to the order of the City & Borough of Juneau” and signing their name on the back of the check. The check should be sent to Payroll or the Treasury Cash Office.

-

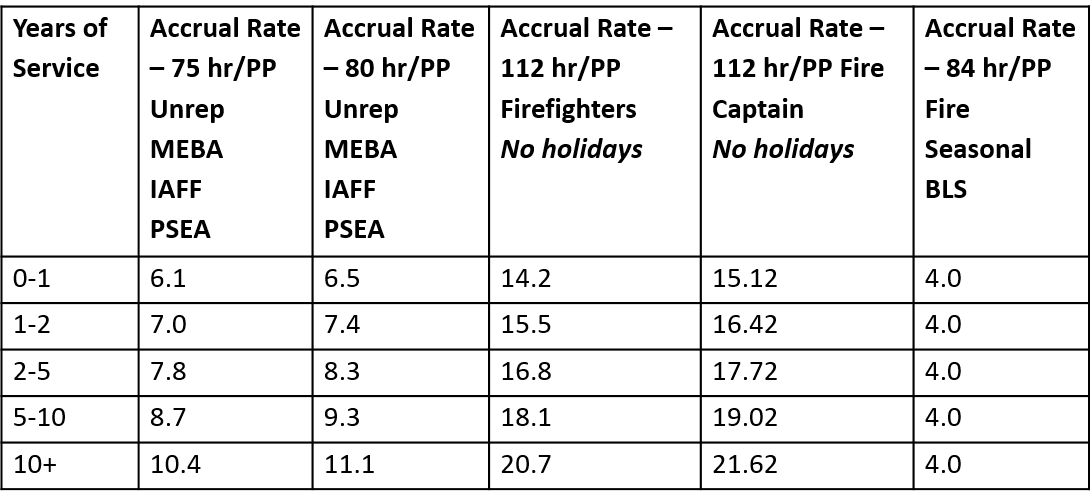

Leave Accrual Rates:

- Part time accruals are prorated – based on hours worked & years of service.

- No credit for periods of seasonal leave/Leave Without Pay (LWOP).

- Table below shows how many hours of leave an employee earns based on years of service:

-

Lost/Damaged Payroll Check:

- If your paper payroll check is lost or damaged, you will need to complete a Certificate of Lost or Stolen Check form and contact Payroll to report it and to request a reissue of that check.

-

Marital or Family Status Change:

There are several changes you likely need to make if your marital and/or family status changes:

-

- W-4 Filing status – complete the following: https://www.irs.gov/pub/irs-pdf/fw4.pdf

- Medical benefits change. Here: https://juneau.org/human-resources/benefits

- Life Insurance change. Here: https://juneau.org/human-resources/benefits

- PERS (divorce decree or marriage certificate required) – Contact Payroll

-

Missing Pay:

See your immediate supervisor to discuss the discrepancy. Your supervisor should contact Payroll to report the situation.

See also: Lost/Damaged Paycheck or Direct Deposit

-

Name Changes:

Federal regulations state that the name on your payroll payments and your W-2 should match the name on your Social Security card. You must change your name with Social Security before changing your name with the City & Borough of Juneau.

Information about that process can be found on the Social Security website here: KA-01981 · Customer Self-Service (ssa.gov)

After receipt of your new social security card, notify your department administrative assistant of the change. The name change must be processed through a Personnel Transaction through Human Resources.

Payroll will report this name change to PERS (additional documentation may be required).

-

New Hire:

New Hire Forms and information can be found here: Employee Forms & Info – City and Borough of Juneau

-

Overpayment:

If an employee is mistakenly overpaid, Payroll will contact them and explain the circumstances of the error, discuss the repayment process and receive consent to deduct the overpayment from future paycheck(s) until the amount has been repaid.

-

Pay Day/Pay Schedule:

All employees are paid biweekly on every other Friday. When the biweekly payday falls on a holiday, pay is issued on the first business day prior to the normal payday.

Paper paychecks are mailed via USPS the day prior to payday. CBJ is not responsible for any postal delays.

You can find detailed information and payroll schedules for pay period dates, time record due dates and paydays using the Pay Schedule found here: Finance – All Forms – City and Borough of Juneau

-

Pay Stub:

Employees can view and print copies of their pay stubs from Lawson Employee Self Service: http://ess.juneau.org; Pay>Paychecks

-

Paycheck Contributions:

Contributions represent fringe benefit amounts paid on your behalf by the City & Borough of Juneau. Examples of Contributions are: PERS & Medicare.

-

Paycheck Deductions & Reductions:

Reductions are items which have been defined by the IRS to not be subject to certain taxes. For example, the Dependent Care Program provided by CBJ is one such plan where the value of the amount withheld from a person’s paycheck is exempt from both social security and federal income tax. Similarly the amount withheld for medical premiums has been defined in the same manner. Items in this category are also known as pre-tax.

Deductions are amounts withheld from gross pay on either an optional or mandatory basis. Deductions may be referred to as post-tax.

Optional deductions are amounts withheld for union dues, parking passes, deferred compensation, & United Way.

Mandatory deductions may be amounts withheld for Medicare, Social Security, garnishments, PERS and IRS levies.

-

Paycheck Taxes:

CBJ must withhold three kinds of taxes from your paycheck:

-

- Social Security tax is 6.2 percent of your salary to a maximum salary of $142,800 for 2021.

- Medicare tax is 1.45 percent of salary up to $200,000 and 2.35 percent for wages in excess of $200,000 paid in the calendar year.

- Federal tax is based on how the Federal Form W-4, Employee’s Withholding Certificate, is completed.

We encourage all employees to periodically review their withholding by using the IRS Paycheck Checkup Tool here: Paycheck Checkup | Internal Revenue Service (irs.gov)

-

Payroll Staff:

Kelly Mercer, Payroll Manager 586-5215 X4060

Jennifer Abbott, Sr. Payroll Technician 586-5215 X4061

Jillian Olson, Payroll Technician 586-5215 X4062

-

Retirement – PERS:

Benefited full time & part time City & Borough of Juneau employees are required to participate in the State of Alaska Public Employees Retirement System (PERS). This is a tiered program depending on your hire date into the system.

If you…

Entered the system between 1/01/1961 – 6/30/1986 = Tier I

Entered the system between 7/01/86 – 6/30/1996 = Tier II

Entered the system between 7/01/1996 – 6/30/06 = Tier III

Entered the system after 6/30/06 = Tier IV

Visit the State of Alaska website for more information:

What retirement plan am I in? | Alaska Division of Retirement and Benefits

Tiers I – III employees are members of the PERS Defined Benefit (DB) Plan.

More information about that plan is here: PERS | Alaska Division of Retirement and Benefits

Tiers I-III employees also may elect to participate in the Voluntary Employee Savings Plan. Additional information can be found here: PERS Voluntary Savings Plan | Alaska Division of Retirement and Benefits

Tier IV employees are members of the PERS Defined Contribution (DCR) Plan.

More Information about this plan is here: DCR Plan | Alaska Division of Retirement and Benefits

If unsure of your Tier or have questions? Contact Payroll at (907) 586-5215, or PERS at (907) 465-4460

-

Social Security Number (SSN) Card Replacement:

You can get a replacement social security card online. All you need to do is log in or create your personal my Social Security account here: my Social Security | SSA

Note: you can’t use the online service if you are requesting a name change or any other change to your card. See Name Change Information.

-

Stale dated paycheck:

A paycheck is considered stale dated if it is held for a period of six months or more. At that point, a bank is no longer obligated to pay on it. If you receive notice from your bank that they are unable to cash a check because it has stale dated, or if you are still holding an un-cashed paper check dated past six months, you will need to contact Payroll to request a reissued check.

-

Termination & Final Paycheck(s) process:

Pay earned in your final pay period will be paid on the normal pay date.

Payouts for your accrued unpaid vacation and/or comp time hours are disbursed as separate payments on the same pay date as your normal last pay day. These final payments will be deposited into your active direct deposit account. If you have no active direct deposit account, a paper check will be mailed to the most recent home address on file for you.

If you wish to roll any unused leave and/or comp time into your MissionSquare account, you must contact Payroll as soon as possible prior to your last payday.

Your department will revoke your access to computer networks, systems, email, and passwords upon your termination. Lawson ESS will remain available for 18 months, provided your password is kept current.

Please remember to go to Employee Self Service to make the necessary changes to your address so your W-2 tax form can be mailed to the appropriate place. Your final W-2 will be mailed to you prior to Jan. 31 of the calendar year following your final paycheck. For example, if you terminate in December 2020, you will receive your personal leave (and/or comp time) payout in January 2021 and you will receive your final W-2 from the CBJ in January 2022.

-

Timecard (UKG) View is wrong:

Contact your Department Admin Assistant or supervisor to discuss any timecard view/access issues.

-

Union Contracts:

Located here: Personnel Rules & Union – City and Borough of Juneau

-

W-2 Copies:

Payroll can email you your W2 (after we verify your identity). Call: (907) 586-5215, opt. 5

-

W-4 Changes:

Reminder: It is good idea to review W-4 forms in December of every year to see if any changes need to be made. Also, if you do claim EXEMPT, you must complete a new Form W-4 by February 15th of each year.