Understanding Postmarks

Understanding Postmarks

CBJ Sales Taxes and Property Taxes must be received by CBJ, or must have a United States Postal Service (USPS) postmark by the deadline to avoid penalties and late fees.

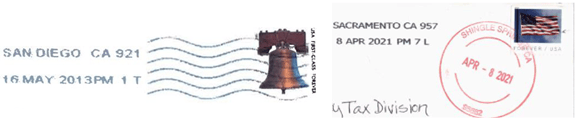

Postmarks are imprints on letters, flats, and parcels that show the name of the USPS office that accepted the mail, along with the state, the zip code, and the date of mailing. The postmark is put on your envelope either by machine or by hand with cancellation bars to indicate that the postage cannot be reused.

Taxpayers who send their payments or sales tax returns by mail are cautioned that the USPS only postmarks certain mail depending on the type of postage used, and may not postmark mail on the same day deposited by a taxpayer. To ensure timely payment of your tax bill, please mail your payment early enough to account of unforeseen delays in mail handling. If you are waiting until just before the due date to mail your payment, it is recommended that you personally witness the postmark being placed on your envelope. If a payment is received after the delinquent date with a late or missing postmark, the payment is considered late, and penalties will be added to your bill.

If a payment is received in the mail without a USPS postmark, it will be considered received on the date it physically comes into the office.

Postage that is Postmarked

- Standard Postage are stamps purchased and affixed to the envelope as evidence of payment for postage. Stamped envelopes are generally postmarked at the USPS processing center on the day that they are delivered from the post office they originated from. This may not be the same date the mail was collected.

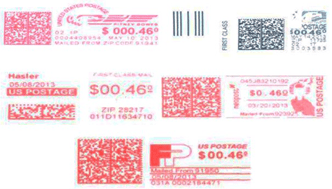

- Postage Validated Imprint (PVI) is postage that is printed and affixed at the post office by the postal clerk at the service window and not returned to the customer. This stamp has the date and time of the acceptance already printed so it does not need to be cancelled at the processing center.

Postage that is NOT Postmarked

If you use these types of postage, the USPS will NOT postmark your mail, and you will be charged late fees if your payment or sales tax return is not received in our office by the deadline.

- Metered mail has a meter stamp applied to it. Metered mail allows the user to manually adjust the date. This mail is not canceled at the USPS processing center.

- Pre-canceled stamps are stamps that do not need to be cancelled by the machine at the processing center. These are stamps bought by bulk mailers who receive a discount for mass mailings.

- Automated Postal Center (APC) stamps can be purchased at self-service kiosks, which are located in Post Office lobbies and have 24 hour a day access. All APC stamps and shipping labels are printed and dispensed at these kiosks. APC stamps can be mailed at any time, so the date does not necessarily reflect the date they were actually mailed.

- Permit imprint is postage that is paid for at the time of mailing through a USPS bulk mail acceptance facility. This mail is not postmarked and the permit holder is charged per piece and per weight.

CAUTION: Online bill payments made through online banking systems are often sent by bulk mail using a permit imprint and do not include a postmark. These payments can take up to two weeks or more to reach our office. Please schedule accordingly.

- Independent mail delivery (FedEx, UPS, etc.) is not postmarked. The shipping date is used to determine the date mailed.

Other Postage Options

The USPS has other postage options that can help track and verify that payments or sales tax returns are received in our office on time. These services include:

- Priority Mail

- Express Mail

- Certificates of Mailing

- Certified Mail

- USPS Tracking

- Signature Mail

- Delivery Confirmation

- Return Receipt

- Restricted Delivery

NOTE: The sender pays the cost of these optional services. Please visit the United States Postal Service website for information on tracking what you send by mail.