Interactive budget tool gives answers to “what if” questions

As the Assembly Finance Committee continues to look deeply at City and Borough of Juneau finances, the Finance Department has provided an interactive “what if” scenario tool as an additional way to engage in the pre-development phase of the budget process for fiscal years 2021 and 2022.

The Finance Committee started delving into CBJ finances in the beginning of October, undertaking a systemic review of the budget, both revenue and expenses. The goal of the process is for the committee to provide direction to the City Manager in advance of the FY21/22 budget development. Major issues at hand include school bond debt reimbursement – a result of the Governor shifting costs to municipalities – and the potential of adding childcare as an ongoing expense. The “what if” scenario tool makes it easier for the Assembly and public to question budgetary assumptions and process. It provides numbers to the discussion and gives a high-level look at the issues.

The interactive tool is an Excel spreadsheet with two tabs – “Revenue Model” and “Debt Model.” The Revenue Model allows you to manipulate CBJ’s property tax and sales tax rates, as well as what’s taxable and what’s exempt. The “Net Change” cells will calculate automatically. The figures displayed when you first open the spreadsheet is what’s currently in place – CBJ’s sales tax is 5 percent year-round and the mill rate is 10.66. Column C are actual values and tax activity from FY19. For explanations on the various exemptions, go here.

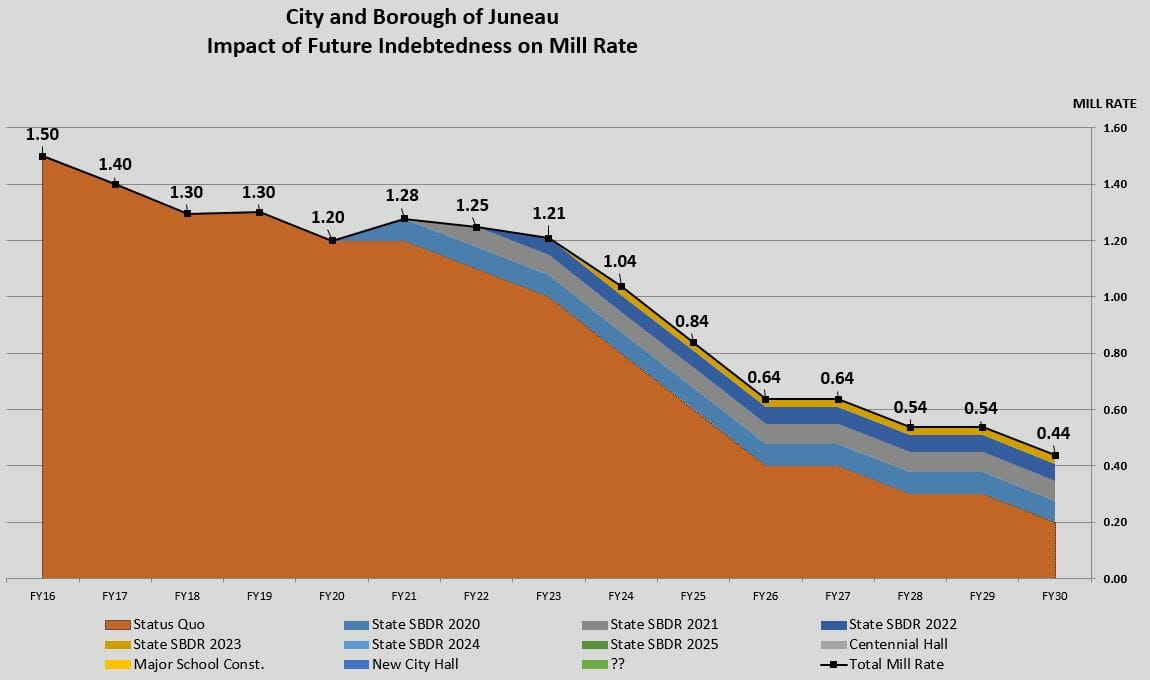

The Debt Model allows you to see the trajectory of the debt service mill rate over the next 10 years. Of CBJ’s current mill rate, 10.66, a portion is allocated to pay off debt – that’s the debt service mill rate. CBJ’s current debt service mill rate for FY20 is 1.2. The orange portion of the graph represents the status quo, or what would happen to the debt service mill rate if CBJ takes on no new debt. This tool shows what happens with the rate as new debt is contemplated. You can manipulate the projects, when to start paying the debt, years of amortization, debt amount, and interest rate.

When using the tool, keep two things in mind: Even if the numbers look good on a spreadsheet, every exemption has a logic and a constituency, and was done for a good reason at the time it was done. And, the tool is just that — a tool. Its existence has no implications beyond being a learning resource. Here’s the interactive “what if” scenario tool.

Following the October 9 meeting, the Finance Committee’s task is to look at the balance of revenues and expenditures, and prioritize programs and services for CBJ’s long-term fiscal sustainability. The committee meets again November 2 at 9 a.m. in Assembly Chambers. These Finance Committee meetings are work sessions where no actual budget decisions are being made.

For more information, contact Finance Director Jeff Rogers at 586-0300 or [email protected].